Each year, the Census Bureau releases three versions of the American

Communities Survey (ACS). These are the 1-Year, the 3-Year, and the

5-Year ACS Estimates. These are released based on the population size of

the municipality. Five year estimates are released for EVERY level of

census geography (down to the block group level) as well as every

municipality (think town, city, and village). Three year estimates are

only released for geographies or municipalities with a MINIMUM

population of 20,000 persons. As a result, many smaller villages and towns are

excluded. One year estimates are released for municipalities with a

MINIMUM population of 65,000. This means they are mostly for counties

and larger cities. For our region, only Oneida County and the Utica Rome MSA have single year estimates available.

The newest Herkimer County ACS data comes through the Three Year ACS Estimates which are NOW AVAILABLE! The most recent 3-Year Estimates are a permanent part of this blog

in the linked area just below the title above. A permanent link will

take you to the most recent 3 year estimates post so you can always

easily find this important data for both counties !

Below are the individual links to the Demographic, Social, Economic and

Housing Profiles for the 2013 Three Year ACS Estimates for Herkimer and Oneida Counties.

2013 OC ACS 3 Year Estimate Demographic Profile

2013 OC ACS 3 Year Estimate Social Profile

2013 OC ACS 3 Year Estimate Economic Profile

2013 OC ACS 3 Year Estimate Housing Profile

2013 HC ACS 3 Year Estimate Demographic Profile

2013 HC ACS 3 Year Estimate Social Profile

2013 HC ACS 3 Year Estimate Economic Profile

2013 HC ACS 3 Year Estimate Housing Profile

A site to help policymakers, government officials, public and private agencies, and the public better understand Census data and related products.

Thursday, October 23, 2014

Friday, October 17, 2014

Weekly Hours Worked and Weeks Worked Per Year By "For Profit", "Non-Profit", "Government" and "Self Employed" Workers

Now that summer vacation has come and gone and we head into winter, I thought it would be interesting to look at the weeks worked each year and the hours worked per week by various parts of the workforce. Specifically I used the 2012 ACS Five Year Estimates PUMS data "Class of Worker" typography to compare those that work in "for profit" businesses, those in "not for profits", those in "government employment" and those that are "self employed".

Below are several graphs which show the distribution of each of these classifications in terms of the hours and weeks worked in the past year. To start with, as you can see below, most of the workforce is working between 31 to 40 hours weekly - the majority of those working at for profit businesses (56%), those in non-profits (55%), and those working in the public sector/government (62%) all work in the 31 to 40 hour range.

The lone exception are workers who are self employed. While more of them work 31 to 40 hours per week (26%) than any other ten hour span, it is not a number approaching the 50% mark as with the other three workforce groups. If we look a bit deep at these numbers the reason why is obvious.

Below are four pie charts showing the percent of workforce for each group that work more than 40 hours per week. In the case of for profits, non-profits, and government workers, somewhere between 38% and 45% worked in excess of 40 hours each week in the past year. However, note the percent of self employed workers who put in more than 40 hours of work each week - nearly 3 in 4 (74%) worked in excess of 40 hours per week. And from the PUMS data, it shows that as many as 15% worked in excess of 50 hours each week!

Below are several graphs which show the distribution of each of these classifications in terms of the hours and weeks worked in the past year. To start with, as you can see below, most of the workforce is working between 31 to 40 hours weekly - the majority of those working at for profit businesses (56%), those in non-profits (55%), and those working in the public sector/government (62%) all work in the 31 to 40 hour range.

|

| Click to Add |

The lone exception are workers who are self employed. While more of them work 31 to 40 hours per week (26%) than any other ten hour span, it is not a number approaching the 50% mark as with the other three workforce groups. If we look a bit deep at these numbers the reason why is obvious.

Below are four pie charts showing the percent of workforce for each group that work more than 40 hours per week. In the case of for profits, non-profits, and government workers, somewhere between 38% and 45% worked in excess of 40 hours each week in the past year. However, note the percent of self employed workers who put in more than 40 hours of work each week - nearly 3 in 4 (74%) worked in excess of 40 hours per week. And from the PUMS data, it shows that as many as 15% worked in excess of 50 hours each week!

|

| Click to Enlarge |

|

| Add caption |

Not surprisingly, most of the workforce works 50 or more weeks per year - regardless of the sector, between 70% and 75% worked 50 to 52 weeks in the last year.

|

| Click to Enlarge |

Here is the distribution of each group's workforce in regard to the number of weeks less than 50 that they worked in the prior year.

|

| Click to Enlarge |

How The Census Bureau Measures Poverty

The US Census Bureau offers two measures of poverty. The official measure of poverty is the more traditional piece based on a 1963 definition of poverty living based largely on cash resource availability. The second measure is the Supplemental Poverty Measure (SPM) which accounts for non-cash benefits from government programs aimed at low income families as well as cash resources of the household.

Below is an infographic comparing the two measures which helps explain their differences more fully. A publication by the Census Bureau, located here, provides some comparisons between the official and SPM data by state. To see local information for your community on poverty, visit this previous post of poverty and income by municipality.

[Source: U.S. Census Bureau]

[Source: U.S. Census Bureau]

Below is an infographic comparing the two measures which helps explain their differences more fully. A publication by the Census Bureau, located here, provides some comparisons between the official and SPM data by state. To see local information for your community on poverty, visit this previous post of poverty and income by municipality.

[Source: U.S. Census Bureau]

[Source: U.S. Census Bureau]

Tuesday, October 14, 2014

A Look at Seniors in Herkimer County From the 2012 ACS Five Year Estimates

Below are two tables showing characteristics of the current population age 65 and over in Herkimer County. New data for Herkimer County will be available at the end of this month in the form of the 2013 ACS Three Year Estimates!

Herkimer County Elderly Profile (Part 1)

|

| Click to Enlarge Part 1 |

Herkimer County Elderly Profile (Part 2)

|

| Click to Enlarge Part 2 |

Monday, October 13, 2014

New Zip Code Data from the IRS

The IRS recently released ZIP

Code data showing selected income and tax items classified by State, ZIP

Code, and size of adjusted gross income. These data are based on individual

income tax returns filed with the IRS and are available for Tax Years

1998, 2001, 2004 through 2012.

The map on the IRS page allows you to select a set of state ZIP Codes and peruse their data.

The data include items such as:

- Number of returns, which approximates the number of households

- Number of personal exemptions, which approximates the population

- Adjusted gross income

- Wages and salaries

- Dividends before exclusion

- Interest received

So pick a year below and take a look at your local ZIP code !

ZIP Code Data

ZIP Code Data 1998–2010

Labels:

Income,

income tax,

IRS

Tuesday, October 7, 2014

An Example of Using ACS Estimates Over Time: Poverty and Family Types 2005 to 2013

As the single year (and the three year) American Community Survey (ACS) data continues to be released, it is important to remember that data now exists going back to 2005 for our area. One of the hopes of the Census Bureau was that such data availability would allow policymakers, as well as the public, the opportunity to look at their region longitudinally, albeit with a certain amount of caution.

As an example, below are the historical estimates of poverty by family type, in this case single mom families versus two parent families in Oneida County. Not surprisingly, poverty rates for single parents are quite a bit higher than they are for dual parent families - the average over the nine years is about 30% for single moms and around 5.5% for dual parent families.

What's important to note is the trends depicted by the shaded areas in the chart, which represent the margins of error for each year. As can been seen, they are rather large for single moms and fairly small for dual parents. This is mainly because of the small number of single mom's sampled (due to their fairly small number within the community). Just be sure to take a look at those margins of error as you explore the ACS data as there are times that they are exceedingly large, and should then be viewed with a some caution.

As an example, below are the historical estimates of poverty by family type, in this case single mom families versus two parent families in Oneida County. Not surprisingly, poverty rates for single parents are quite a bit higher than they are for dual parent families - the average over the nine years is about 30% for single moms and around 5.5% for dual parent families.

|

| Click to Enlarge |

What's important to note is the trends depicted by the shaded areas in the chart, which represent the margins of error for each year. As can been seen, they are rather large for single moms and fairly small for dual parents. This is mainly because of the small number of single mom's sampled (due to their fairly small number within the community). Just be sure to take a look at those margins of error as you explore the ACS data as there are times that they are exceedingly large, and should then be viewed with a some caution.

Labels:

1 Year ACS,

ACS,

families,

Poverty,

single mothers

Thursday, October 2, 2014

Does Buying Local REALLY Matter?

A post at Demo Memo, a great site analyzing demographics data, looked at the issue of local businesses and the impact "buying local" has. As they asked the question, "Does buying local matter to economic well being?"

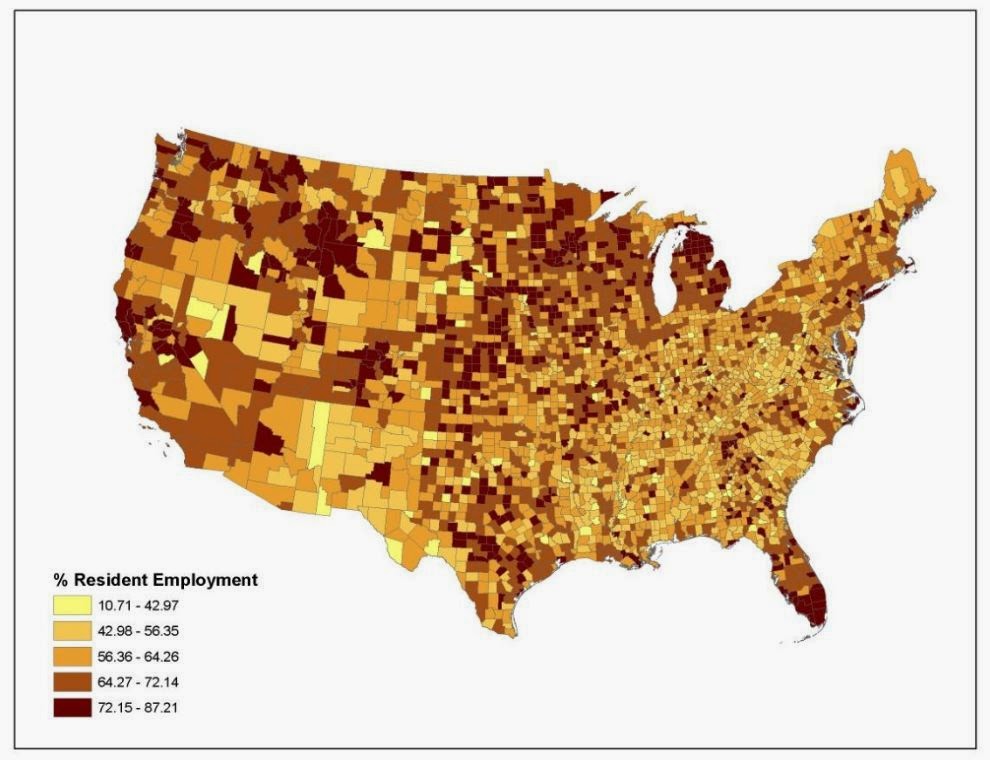

What they found was that this question is addressed in a Federal Reserve Bank of Atlanta analysis of county level economic data for the 2000 to 2009 time period. Economist Anil Rupasingha examines the local share of employment by county and compares those numbers to real per capita income growth, employment growth, and poverty.

In most counties, employment in locally-owned businesses surpasses employment in "nonresident-owned" businesses. But the local share varies greatly by county, which you can see at a glance in the county-level maps included in the analysis. The share of employment in locally-owned businesses varies by county from 11 to 87 percent. The share of employment in nonresident-owned businesses varies by county from zero to 85 percent.

"Historically, the most popular local economic development approach was to attract businesses outside a particular municipality, state, or region," says Rupasingha. But theories about local economic development are changing, he says, and "economic development based on local entrepreneurship is increasingly gaining traction." Which approach is better?

Local is better. According to the study's results, the greater the local entrepreneurship, the greater the per capita income and employment growth and the lower the poverty. Also and interestingly, smaller local businesses have a greater effect on local economic performance than larger local businesses. "My results suggest that fostering smaller local businesses may be good local economic development policy," Rupasingha concludes.

Locally, businesses with less than 50 employees make up about 98% of companies in Herkimer county and 95% of those in Oneida County. There are more than 10,000 people who consider themselves "self employed" in the region ! So obviously small businesses play a big part of our local economy.

What they found was that this question is addressed in a Federal Reserve Bank of Atlanta analysis of county level economic data for the 2000 to 2009 time period. Economist Anil Rupasingha examines the local share of employment by county and compares those numbers to real per capita income growth, employment growth, and poverty.

In most counties, employment in locally-owned businesses surpasses employment in "nonresident-owned" businesses. But the local share varies greatly by county, which you can see at a glance in the county-level maps included in the analysis. The share of employment in locally-owned businesses varies by county from 11 to 87 percent. The share of employment in nonresident-owned businesses varies by county from zero to 85 percent.

Percent of Residents Working in Locally Owned Businesses (2007)

|

| Click to Enlarge |

"Historically, the most popular local economic development approach was to attract businesses outside a particular municipality, state, or region," says Rupasingha. But theories about local economic development are changing, he says, and "economic development based on local entrepreneurship is increasingly gaining traction." Which approach is better?

Local is better. According to the study's results, the greater the local entrepreneurship, the greater the per capita income and employment growth and the lower the poverty. Also and interestingly, smaller local businesses have a greater effect on local economic performance than larger local businesses. "My results suggest that fostering smaller local businesses may be good local economic development policy," Rupasingha concludes.

Locally, businesses with less than 50 employees make up about 98% of companies in Herkimer county and 95% of those in Oneida County. There are more than 10,000 people who consider themselves "self employed" in the region ! So obviously small businesses play a big part of our local economy.

Subscribe to:

Comments (Atom)