While I have no way of knowing how accurate those figures are, the website does provide some interesting information on tax exempt organization by county. Data for both Herkimer County and Oneida County tax exempt and nonprofit organizations are on the website. The data includes the total number of organizations, their income, and the value of their assets within each county. There is also a full listing of what organizations are considered tax exempt or non-profit, but to be honest the list appears a bit out of date despite the claim that it was updated in January of this year.

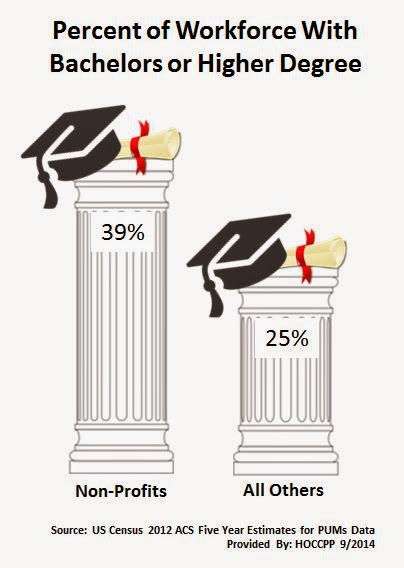

Regardless, it is another resource when researching the impact of local non-profits. Within the ACS of the US Census Bureau, workers are classified such that those that workers within charitable, nonprofit, or tax exempt organizations can be pulled out and examined as a group. Below are just a few of the types of data that you can find allowing for a comparison of employees who work for nonprofit organizations and those that work in any other type of job.

For example, roughly 12,500 people work for nonprofits in the region. This is about 9% of the workforce, or one out of every eleven jobs.

|

| Click to Enlarge |

The non-profit workforce is overwhelmingly female - far more so than the rest of the workforce. Two out of every three workers in the nonprofit sector are female. Among all other workers, less than half of the rest of their workforce is female.

Both nonprofit workers and the rest of the workforce have similar experiences with marriage. Roughly two out of three have ever been married, and around half are presently married.

In terms of a variety of social and cultural factors, more of the nonprofit workforce is black, and more of it is disabled, than compared to the rest of the workforce. They are less likely, however, to be Hispanic, or to be foreign born.

|

| Click to Enlarge |